The SHO-BOND Group (the “Group”) expressed its support for the TCFD* recommendations and joined the TCFD Consortium in July 2022. Based on its corporate philosophy of “Inheriting and passing on social infrastructure to the next generation in good condition,” the Group is committed to “contribution to the development of sustainable cities” as one of its Materialities and is aware that combatting climate change is an important management challenge.

Based on the recognition that a longer service life of infrastructure contributes to reducing greenhouse gas emissions, we will make efforts so that we can contribute to realizing a sustainable society. These efforts include information disclosure and other initiatives related to climate change, in addition to core business activities as an infrastructure maintenance specialist.

* Task Force on Climate-Related Financial Disclosures

TCFD’s four recommended disclosure themes

Governance

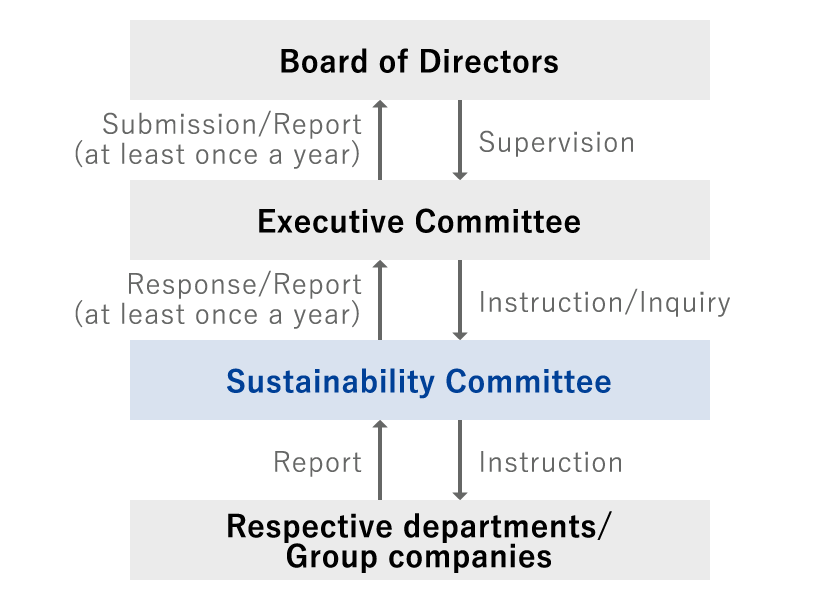

The Group has established a Sustainability Committee, chaired by President and Representative Director and composed of outside directors and other members. The Committee deliberates on issues about sustainability management, including important policies and measures related to the environment such as responses to climate change, and submits/reports the results of deliberation to the Executive Committee. The Board of Directors also exercises supervision over climate-related risks and opportunities by discussing and making decisions on important matters.

Policies and measures discussed and decided on at the meetings of the Board of Directors are communicated to each department and group company and reflected in their respective business operations.

StrategyAssumptions for Scenario Analysis

The Group conducted a scenario analysis to identify and assess the impact on its overall business management of the risks and opportunities associated with the “transition” to a low-carbon economy and those associated with the “physical” changes brought about by climate change.

As assumptions for the scenario analysis, we selected the 2℃ or lower and 4℃ scenarios by referring to several existing scenarios published by the International Energy Agency (IEA), the Intergovernmental Panel on Climate Change (IPCC), and other organizations. Businesses subject to the analysis are the domestic construction business and the manufacturing and sales business of repair and reinforcement materials; the time horizon is assumed to be up to the year 2030.

2℃ or lower scenario

A scenario assuming that countries around the world will take strict international measures against climate change and that the increase in global average temperature by 2100 will be kept at 2℃ or lower above pre-industrial levels.

* Existing scenarios used as reference

SDS (Sustainable Development Scenario)

RCP2.6: Representative Concentration Pathways

4℃ scenario

A scenario assuming that countries around the world will not take stricter measures than those currently in place and that the global average temperature by 2100 will rise 4℃ above pre-industrial levels.

* Existing scenarios used as reference

SSP5: Shared Socioeconomic Pathways

RCP8.5

StrategyRisks and Opportunities Associated with Climate Change

Transition Risks and Opportunities

| Classifica-tion | Risks/opportunities | Description | Impact | Businesses subject to analysis | ||||

|---|---|---|---|---|---|---|---|---|

| 2℃ or lower | 4℃ | Domestic construction |

Manufacturing and sales |

|||||

| Transition risks/opportunities | Policies/laws and regulations | Introduction of carbon pricing | Risk | Increased procurement costs for energy and materials | ○ | - | ✔ | ✔ |

| Oppor-tunity | Increased price competitiveness with the delivery of low-carbon construction services and products in the field of repair and reinforcement | ○ | - | ✔ | ✔ | |||

| Introduction of more aggressive targets/policies for CO2 emissions reduction by countries around the world | Oppor-tunity | Due to CO2 emissions regulations, the number of life-extending works of buildings and infrastructures increases while the amount of overall investments in construction decreases | ○ | - | ✔ | ✔ | ||

| Market | Changes in customer behaviors | Risk | Decreased transactions due to our inability to adequately respond to customers’ requests for reducing CO2 emissions | ○ | - | - | ✔ | |

| Oppor-tunity | Increased competitiveness as an infrastructure maintenance specialist offering low-carbon construction, as low CO2 emissions are highly regarded in tenders and selection of construction methods | ○ | - | ✔ | - | |||

| Rises in raw materials costs | Risk | Surges in the purchase prices of resin-based materials and steel materials as a result of decreased production of naphtha and iron ore | ○ | - | - | ✔ | ||

| Reputation | Changes in reputation among shareholders and investors | Oppor-tunity | Increased ESG investment in the SHO-BOND Group as an infrastructure maintenance specialist due to being highly regarded for its low CO2 emissions | ○ | - | ✔ | - | |

Physical Risks and Opportunities

| Classifica-tion | Risks/opportunities | Description | Impact | Businesses subject to analysis | ||||

|---|---|---|---|---|---|---|---|---|

| 2℃ or lower | 4℃ | Domestic construction |

Manufacturing and sales |

|||||

| Physical risks/opportunities | Policy | Acceleration of national resilience measures | Risk | Increased demand for watershed flood control and disaster restoration work, rather than seismic reinforcement work and service life extension work, in the face of growing severity of weather disasters | ○ | ○ | ✔ | - |

| Oppor-tunity | Increased demand for infrastructure maintenance to counter natural disasters | ○ | ○ | ✔ | ✔ | |||

| Chronic | Increase in average temperature | Risk | Decreased productivity in line with increased heat stroke cases among on-site workers | ○ | ○ | ✔ | - | |

| Increased costs for improving working environment and introducing equipment, etc. to prevent heat stroke | ○ | ○ | ✔ | - | ||||

| Worsening worker shortages due to deteriorating outdoor working conditions | ○ | ○ | ✔ | - | ||||

| Acute | Growing severity of weather disasters | Risk | Increased costs due to process delays at disaster-stricken sites | ○ | ○ | ✔ | - | |

| Supply chain disruption | ○ | ○ | ✔ | ✔ | ||||

| Damage to or shutdown of operations at disaster-stricken own factories or contracted manufacturing plants | ○ | ○ | - | ✔ | ||||

StrategyCountermeasures Based on Scenario Analysis

For the climate-related risks and opportunities identified, we have sorted out necessary countermeasures as shown in the table below. By implementing the countermeasures identified in this report, we will contribute to developing sustainable cities and will achieve sustainable growth by enhancing the resilience of our business.

| Risks/opportunities covered | Countermeasures | |||

|---|---|---|---|---|

|

Risk |

|

|

|

| Oppor-tunity |

|

|||

|

Oppor-tunity |

|

|

|

|

Risk |

|

|

|

|

Risk |

|

|

Risk Management

The Group’s Sustainability Committee takes the lead in identifying and assessing climate-related risks in each of our business segments. We will also review and implement measures to address these issues with a view to future changes in regulations, society, technology, weather conditions, etc., and manage and improve the status of these measures.

The Sustainability Committee reports the climate-related risks discussed at its meetings to the Risk Management Committee, chaired by President and Representative Director. These risks are then combined with other risks and submitted/reported to the Executive Committee. Finally, the Board of Directors discusses and makes decisions. Through such comprehensive risk management, we will address climate-related risks that will become increasingly diverse and severe in the future.

Metrics and Targets

To realize a decarbonized society—the basic principle underlying the Act on Promotion of Global Warming Countermeasures, the Group has set targets of reducing its CO2 emissions(Scope 1 and 2) 25% from FY2022 levels by FY2031 and ultimately achieving carbon neutrality by FY2051.

CO2 Emissions Reduction Targets

| Metrics | Base year | Targets | ||

|---|---|---|---|---|

| FY2022 | FY2031 | FY2051 | ||

| CO2 emissions (Scope1 and 2) |

Total emissions | 5,238 t-CO2 | 3,929 t-CO2 (-25%) |

Net zero |

CO2 Emissions (Scope 1, 2, and 3)

| Category | Unit | FY2022 | FY2023 | FY2024 | Remark | |

|---|---|---|---|---|---|---|

| Scope 1 | t-CO2 | 2,667 | 2,805 | 2,595 | ||

| Scope 2 | 2,571 | 2,669 | 2,417 | |||

| Total of Scope1 and 2 | 5,238 | 5,474 | 5,012 | |||

| (CO2 emissions intensity) | t-CO2/100 million yen | 6.5 | 6.5 | 5.9 | ||

| Scope 3 | 1.Purchased goods and services | t-CO2 | 95,032 | 99,402 | 95,989 | |

| 2.Capital goods | 11,400 | 6,109 | 4,074 | |||

| 3.Fuel- and energy-related activities (not included in Scope 1 or Scope 2) |

775 | 791 | 796 | |||

| 4.Upstream transportation and distribution | 118 | 117 | 116 | |||

| 5.Waste generated in operations | 1,746 | 2,946 | 4,449 | |||

| 6.Business travel | 422 | 525 | 527 | |||

| 7.Employee commuting | 245 | 254 | 225 | |||

| 8.Upstream leased assets | - | - | - | Not subject to calculation | ||

| 9.Downstream transportation and distribution |

270 | 323 | 374 | |||

| 10. Processing of sold products | - | - | - | Not subject to calculation | ||

| 11. Use of sold products | - | - | - | Not subject to calculation | ||

| 12. End-of-life treatment of sold products | - | - | - | Not subject to calculation | ||

| 13. Downstream leased assets | - | - | - | Not subject to calculation | ||

| 14. Franchises | - | - | - | Not subject to calculation | ||

| 15. Investments | - | - | - | Not subject to calculation | ||

| Total of Scope 3 | 110,008 | 110,468 | 106,550 | |||

| Total of Scope1, 2, and 3 | 115,246 | 115,942 | 111,562 | |||